In this article, reposted with permission by Global Water Intelligence, Kurita Executive Officer Jordi Verdés discusses new business approaches to drive value creation as we increase our presence outside of Asia.

New approaches to value creation lie at the heart of the Japanese company’s drive to increase its presence outside of Asia. What is its strategy?

A suite of prudent business collaborations in EMEA and the Americas is allowing Kurita to apply its unique approach to value creation in order to generate above-market growth and penetrate previously underserved segments of the water market.

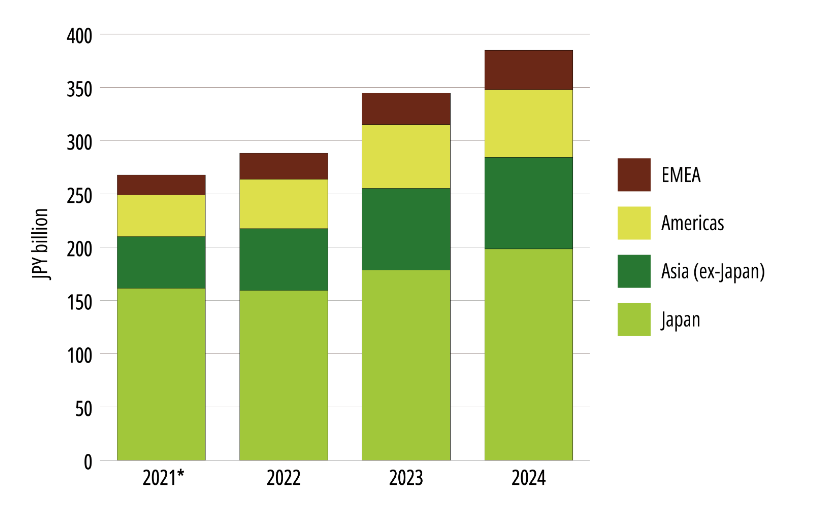

As it gears up for its 75th anniversary celebrations in November, the Tokyo-listed pure-play can reflect on the fact that it now generates nearly half its global revenues from outside Japan (see chart).

As it gears up for its 75th anniversary celebrations in November, the Tokyo-listed pure-play can reflect on the fact that it now generates nearly half its global revenues from outside Japan (see chart).

Ten years ago, the picture was very different. Although the group had an international presence after following some of its Japanese customers overseas, the organic growth potential was limited, and the company decided to branch out by acquiring Israel Chemicals’ water solutions, paper solutions, and alumina compounds business in Europe.

A series of acquisitions in the US followed, and Kurita is now engaging with start-ups and decarbonisation specialists to optimise its CSV (Creating Shared Value) approach against stiff competition across a global client base.

The acquisition of the Arcade group last year closed immediately before the entry into force of the European Chips Act, which is designed to boost Europe’s competitiveness in semiconductor technologies and applications. Having in-house expertise in the turnkey installation of ultrapure water production plants and wastewater treatment plants for the European semiconductor industry positions Kurita at the heart of one of the hottest areas of the global water market.

“It’s probably one of the biggest growth drivers that we will see in the coming years in Europe and America,” observed Jordi Verdés, head of EMEA and Americas at Kurita. “There is a lot of money in the market, and I think the challenge that the industry is facing is that the demand is huge,” he told GWI.

Speed and quality of delivery will therefore be vital, especially given the often rapid decision-making processes on the client side. A successfully executed contract to supply a water treatment facility for a new semiconductor fabrication plant can swiftly result in follow-up orders from the same client as it takes advantage of financial incentives to roll out new capacity elsewhere in response to growing demand.

While the reality of the industry is that most chip manufacturers tend to outsource the ultrapure water and wastewater components of a fab to different suppliers, Kurita’s flexibility on delivery – and its ability to meet the chemical needs of the plant in-house – put it in a strong starting position.

How many of these plants end up being delivered as build-own-operate (BOO) packages using off-balance sheet finance remains to be seen, although Kurita’s historical reference base of large-scale BOO installations in the electronics industry gives it a unique perspective on clients’ expectations around value.

“It is the ultimate expression of the value that we can provide,” Verdés states. “By designing and operating a plant ourselves, we can leverage chemical experience and maintenance experience to provide value. While our initial focus was on ultrapure water for the electronics industry, we see more and more demand on the water reclamation and water reuse side,” he told us.

As the conversation shifts towards delivering a more holistic value proposition by lessening the environmental impact of day-to-day industrial operations, some clients are beginning to embrace the concept of value-sharing as a way to incentivise suppliers to further optimise and tailor their solutions.

“We start to see customers that are ready to talk about sharing value – if you say you will save me 20% of the water, 10% of the cost can be for you, and 10% for me. This type of model is just starting,” said Verdés.

The emergence of younger decision-makers at large industrial concerns also means that the nature of the discussion is increasingly focused around more than just the impact on the client’s bottom line.

“If you go to a younger customer and say: ‘we can help you to reduce the water impact, the environmental impact, and the CO2 emissions’, they are willing to listen,” Verdés observed. “In the past, sustainability was a nice marketing slogan many companies were using. Nowadays, it is a must.”

Green chemistries

Last month, Kurita announced a collaboration with bio-based chemicals manufacturer and decarbonisation specialist Solugen to develop a suite of greener chemistries for water treatment.

“One of the unique capabilities that we have – which many water treatment companies do not – is that we are able to design our own polymers,” commented Verdés. “Our cooperation with Solugen is focused on using waste organics to build polymers which are carbon-neutral or even carbon-negative,” he explained.

It is collaborations like this which will help to keep Kurita’s client-facing offering at the cutting edge, as it competes with well-capitalised chemicals suppliers such as Ecolab and Solenis, and plant suppliers like Ovivo, Veolia, Nomura Micro Science, and Organo.

Plugging artificial intelligence into the equation gives it a further edge, and the completion last year of the buyout of US-based Fracta, which originally developed machine learning capabilities for water pipe assessment, was followed up this year by the establishment of a global data integration platform to centralise the collection, storage, and utilisation of operating, chemical dosing, and water quality data.

The move builds on the Meta-Aqua project initiated when Kurita first took a stake in Fracta back in 2020. This aims to shorten the design process for water treatment facilities by using AI. By leveraging the core know-how within Fracta, Kurita is also developing an AI application for the optimisation of membrane life in treatment plants.

“The main purpose of the Fracta transaction has been to integrate new skills into the Kurita group. It was a catalyser of new opportunities and new ways of doing business,” Verdés explained.

Kurita is also increasingly willing to invest in start-ups as a way to super-charge its in-house R&D efforts, which are currently centred in Viersen (Germany), Japan, Singapore, San Diego, and Minneapolis. Last year, it took a stake in US-based Aqua Membranes, which claims to reduce energy consumption in membrane systems by 20% using proprietary printed membrane spacers.

Verdés insists that the M&A focus for the group going forward will be on technologies, rather than on rampant geographical expansion, although it is willing to consider inorganic opportunities in order to bolster its presence in Latin America.

“As part of our R&D capabilities, we have people focusing on exploring new opportunities to cooperate with start-ups, but our M&A focus is on technologies – not on buying market share,” he told GWI. “The biggest differentiation at Kurita is that we really focus on water and nothing else. I think that positions us as quite a unique player in this industry.”